Roaming and Core Network

Risk Management

-

Revenue Assurance

- Usage Assurance

- Provisioning Assurance

- Rating & Billing Validation

- Prepaid Balance Validation

-

Fraud Management

- Revenue Share Fraud

- Bypass Fraud

- Roaming Fraud

- CLI Spoofing & Robocalling

- VoIP & SIP Fraud

- Dealers Fraud

- Subscription Fraud

- Data Fraud

- Telecom Wholesale Fraud

- SMS Bypass Fraud

-

Business Assurance

- IoT Assurance

- Collections Assurance

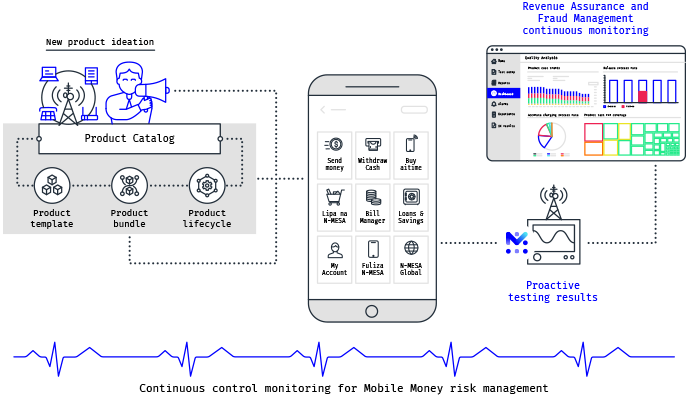

- Mobile Money

- Partner Incentives Assurance

- Cost and Margin Assurance

- Flash Calls

-

Business Operations

- Collections Management

-

Proactive Risk Management

- Proactive Revenue Assurance

- Proactive Fraud Management

- Proactive Business Assurance

Network Security

-

Signaling Firewall

- Cross Protocol Firewall

- SS7 Firewall

- Diameter Firewall

- GTP Firewall

- SIP Firewall

- Signaling Outbound Firewall

- Security Edge Protection Proxy (SEPP)

-

SMS Firewall

- A2P Grey Route Firewall

- SMS SPAM Firewall

-

Security Services

- Threat Intelligence

- Penetration Testing Services

-

Cyber Surveillance

- Threat Monitoring

Testing and Monitoring

-

Domestic Network Testing

- SITE Platform

- 5G SA & NSA Performance Testing

- Core Network Testing

- Automation Framework

- RoboShark Automated PCAP Analysis

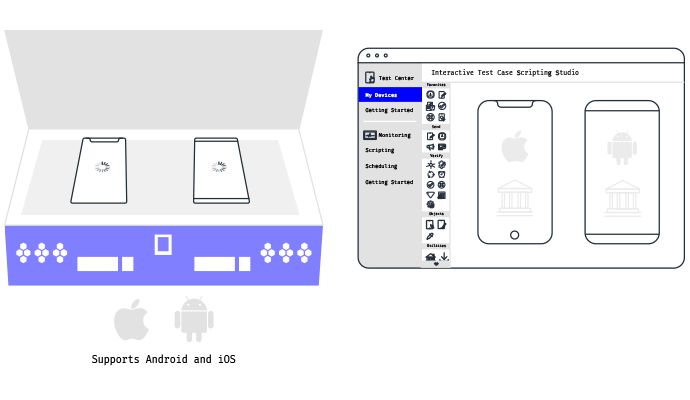

- Smartphone-based Testing

- Emergency Services Testing

- Video Performance Testing

- IoT & eSIM Performance Testing

- IMS and VoLTE Testing

- CS Voice, Data & Messaging Testing

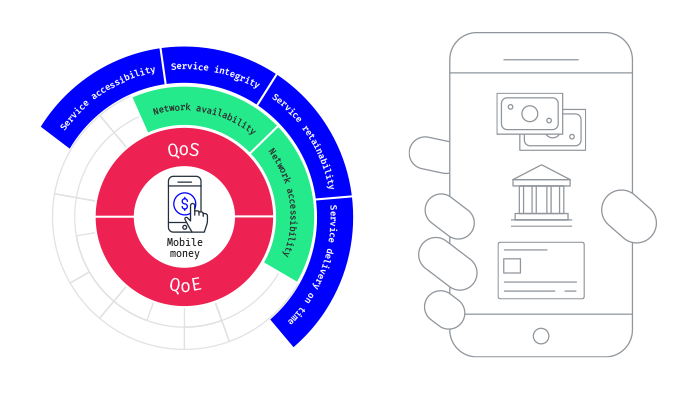

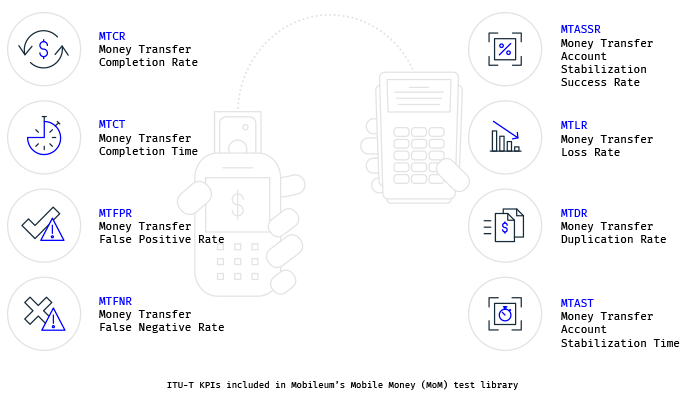

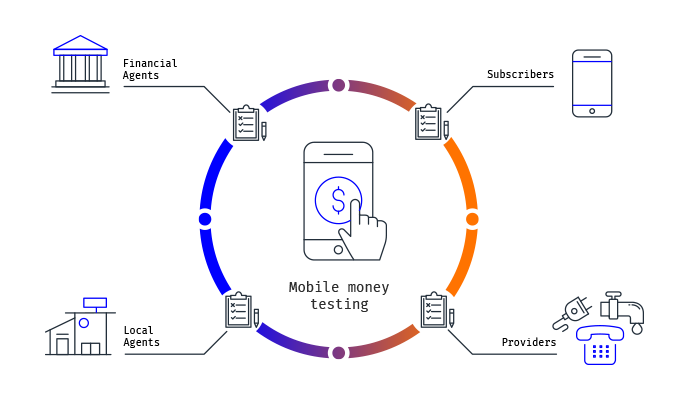

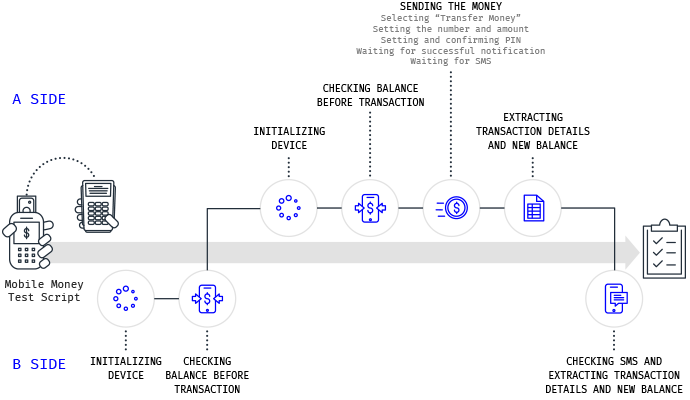

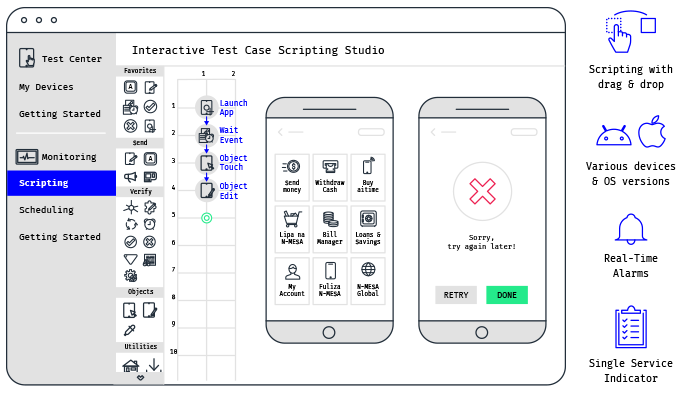

- Mobile Money Testing

-

International Network Testing

- Roaming Quality Testing

- Global IoT Connectivity Testing

- Performance Intelligence

- VoLTE Roaming Testing

-

Lab & Performance Testing

- dsTest Platform

- 5G Lab Testing

- 4G Core & VoLTE Testing

- Cellular IoT Testing

- 3G 4G 5G Functional & Compliance Testing

- Automated Signaling Firewall Testing

- dsTest Support Materials

Internet of Things (IoT)

Service & Network Assurance

Check our Services

Check out our exclusive insightful content